Group Health Plans

- Free Consultation & Analysis of Current Employee Benefit Package

- Customized Competitive and Innovative Plans to Attract & Retain Top Employees

Affordable Group Health Insurance Plans

Looking for quality group health insurance? Allow the experts at Mussolino & Associates assist you. We've been finding the right health plans for business owners like you for 30 years.

Call us today for a free group health insurance quote.

Fully Insured Plans

- Employers with 2 or more employees

- Plans can be written as fully insured group plans with top 4 carriers

- CareFirst, United Healthcare, Cigna and Aetna

- Offer a variety of options

- Place risk solely on the insurance carrier

- Work well with supplemental coverages to limit employee's exposure to large out of pocket expenses that would otherwise be applied to deductibles and co-insurance.

Level Funded Plans

- Starting to become more popular with employers due to rising cost of the traditional fully insured plans

- Self-funded plans that act like fully insured plans

- Stop-Loss Insurance can be added to protect employers from catastrophic claims exceeding pre-determined levels and maintaining set monthly premium

Self Funded Plans

- Leading option for companies who are struggling with the rising costs of healthcare

- Can reduce costs by as much as 40% over traditional fully insured plans

- Employer takes on the financial risk of the plan & pays out of pocket for employee healthcare expenses as they occur

- Two main costs to be considered

- Fixed Costs are charged based on plan enrollment. Also known as Per Employee Per Month (PEPM) fees

- Variable Costs are payment of health care claims incurred & vary from month to month depending on health care use by covered persons

- Stop-Loss Insurance can be added to limit risk and cover claims that exceed the stop-loss amount.

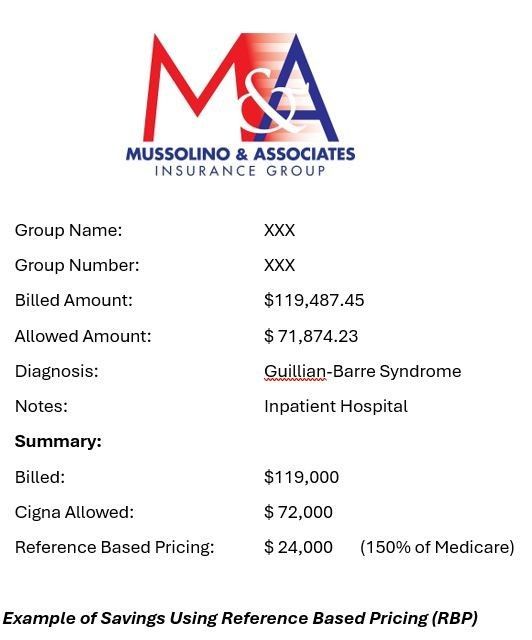

Reference-Based Pricing (RBP)

- A self-funded health plan design strategy that caps what the plan will pay providers (allowable amount) for a covered service.

- An allowable amount is based on a chosen metric or reference point often set as a Medicare reimbursement rate. Platform typically used is Medicare plus 150

- Can reduce costs by as much as 45% over fully insured plans

Minimally Essential Coverage (MEC)Plans

- The Affordable Care Act states that all individuals must have health benefits and all employers with 50 or more full-time employees must provide coverage to all full-time employees or they are subject to fines/penalties

- MEC Plans provide affordable healthcare coverage for the average person. Adding a hospital indemnity policy can offset high deductibles and out-of-pocket expenses so that an emergency does not become a financial crisis.

- MEC Plans work great as a low option plan with a major medical plan being offered as a high option. A good MEC Plan will offer prescription drugs that include specialty drug coverage. They are limited in what they cover, so proper education is required when someone is considering a MEC Plan verses a major medical plan.

Share On: