,

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Group Health

Group Health Plans

- Free Consultation & Analysis of Current Employee Benefit Package

- Customized Competitive and Innovative Plans to Attract & Retain Top Employees

Affordable Group Health Insurance Plans

Looking for quality group health insurance? Allow the experts at Mussolino & Associates assist you. We've been finding the right health plans for business owners like you for 30 years.

Call us today for a free group health insurance quote.

Fully Insured Plans

- Employers with 2 or more employees

- Plans can be written as fully insured group plans with top 4 carriers

- CareFirst, United Healthcare, Cigna and Aetna

- Offer a variety of options

- Place risk solely on the insurance carrier

- Work well with supplemental coverages to limit employee's exposure to large out of pocket expenses that would otherwise be applied to deductibles and co-insurance.

Level Funded Plans

- Starting to become more popular with employers due to rising cost of the traditional fully insured plans

- Self-funded plans that act like fully insured plans

- Stop-Loss Insurance can be added to protect employers from catastrophic claims exceeding pre-determined levels and maintaining set monthly premium

Self Funded Plans

- Leading option for companies who are struggling with the rising costs of healthcare

- Can reduce costs by as much as 40% over traditional fully insured plans

- Employer takes on the financial risk of the plan & pays out of pocket for employee healthcare expenses as they occur

- Two main costs to be considered

- Fixed Costs are charged based on plan enrollment. Also known as Per Employee Per Month (PEPM) fees

- Variable Costs are payment of health care claims incurred & vary from month to month depending on health care use by covered persons

- Stop-Loss Insurance can be added to limit risk and cover claims that exceed the stop-loss amount.

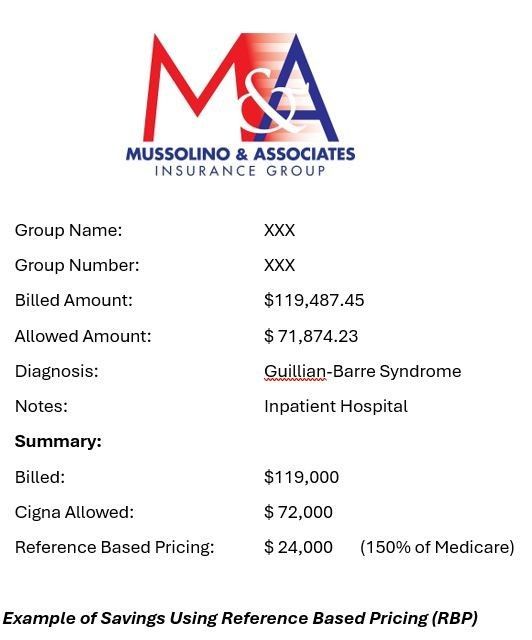

Reference-Based Pricing (RBP)

- A self-funded health plan design strategy that caps what the plan will pay providers (allowable amount) for a covered service.

- An allowable amount is based on a chosen metric or reference point often set as a Medicare reimbursement rate. Platform typically used is Medicare plus 150

- Can reduce costs by as much as 45% over fully insured plans

Minimally Essential Coverage (MEC)Plans

- The Affordable Care Act states that all individuals must have health benefits and all employers with 50 or more full-time employees must provide coverage to all full-time employees or they are subject to fines/penalties

- MEC Plans provide affordable healthcare coverage for the average person. Adding a hospital indemnity policy can offset high deductibles and out-of-pocket expenses so that an emergency does not become a financial crisis.

- MEC Plans work great as a low option plan with a major medical plan being offered as a high option. A good MEC Plan will offer prescription drugs that include specialty drug coverage. They are limited in what they cover, so proper education is required when someone is considering a MEC Plan verses a major medical plan.

FREE Health Insurance Analysis

Call us for a FREE quote.

(301) 791-4892

(301) 791-4892

VISIT US

,

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

HOURS

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

HOURS

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

Sunday

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

CONTACT US

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

This is a placeholder for the Yext Knolwedge Tags. This message will not appear on the live site, but only within the editor. The Yext Knowledge Tags are successfully installed and will be added to the website.

Hi. Do you need any help?

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2025

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.

Share On: